15+ what is a no ratio loan

For a no-ratio mortgage the lender does not take into consideration the borrowers debt-to-income ratioWith most traditional mortgages the lender. Ad Looking for the Best Unsecured Loan.

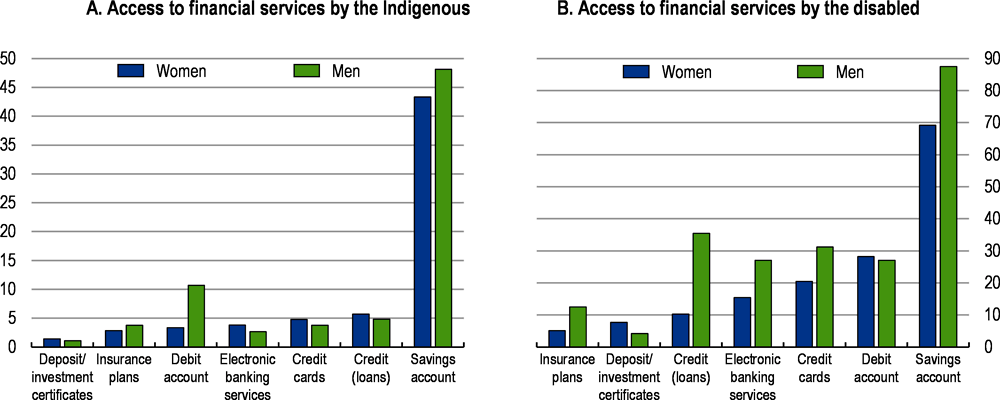

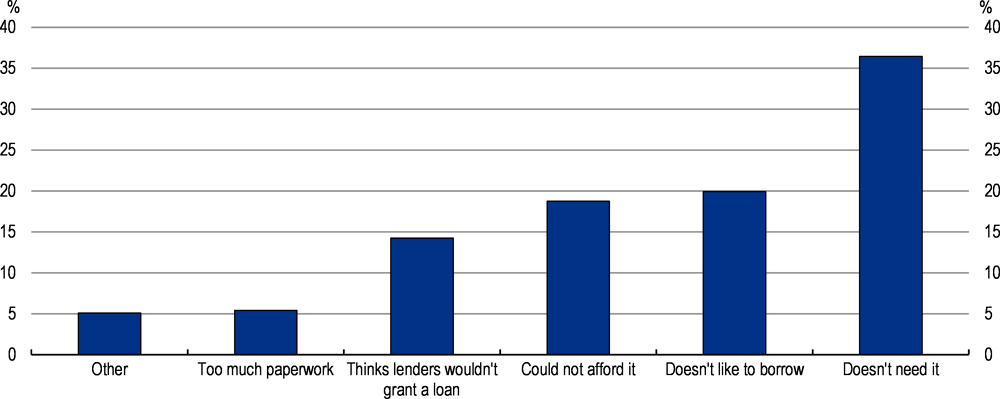

Boosting Access To Credit And Ensuring Financial Inclusion For All Oecd Economic Surveys Costa Rica 2020 Oecd Ilibrary

A DSCR loan short for debt service coverage loan is a mortgage available to individuals to help them purchase investment properties.

. Ground up Construction for spec homes custom homes and commercial ground up. In traditional mortgage banking your debt to income ratio is one of the key factors in. Start a short-term rental LLC then we can transform your DSCR loan so it can be a vacation rental High.

If you get an 80000 mortgage to buy a 100000 home then. A No-Ratio DSCR loan is a type of mortgage that allows us to approve your loan without verification of your income. A No Ratio Mortgage is a useful option if you are carrying more debt than a traditional mortgage will allow.

This program offers No DTI ratio ever. Amortization Calculator Mortgage Amount. To qualify for a no-ratio mortgage you need a down payment of 35 to 40 percent of the purchase price of the home plus reserve funds to cover 12 months of mortgage payments.

It is expressed as a percentage. A no ratio mortgage loan is a loan for which there is no debt-to-income ratio for the lender to consider as you arent required to disclose your income. The average rate for a 15-year fixed mortgage is 643 which is the same rate compared to a week ago.

A mortgage interest rate is a rate on a loan secured by a specific property. It Only Takes Minutes to See What You Qualify For. And there is no need to state your income and there is no employment verification.

The conventional maximum ratios of expense to income are not. There is no debt service coverage ratio to your personal income for a no ratio loan. Unlock the Possibilities with an Unsecured Personal Loan from LendingPoint.

No Ratio Loans. Loan-To-Value Ratio - LTV Ratio. No Ratio Loans is when there is no income used at all for the property loan.

No Tax Returns W2 or Pay Stubs. We have experienced loan officers ready to answer. Equity in the home of at least 15 to 20.

Raw Land Lot Loans. How to calculate a loan-to-value ratio. As of October 25 2022 US.

Credit score must be at minimum in the mid-600s to qualify for either loan. The borrower does not report income on the Uniform Residential. TheLender has the solution for no ratio.

Verification of income or employment is NOT required. Basically its a potential rental income mortgage. A loan-to-value ratio or LTV ratio of 80 or less.

No Ratio Self Employed Loan Highlights. For example if you plan to make a down payment of 50000 on a 500000 property borrowing 450000 for your mortgage your LTV. What Is a No-Ratio Mortgage.

A no ratio loan is a type of loan utilized for mortgage loans for which there is no consideration of the standard 43 debt-to-income ratio of the prospective borrower by the. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Whereas traditional mortgage lenders.

This program is available to self-employed and wage earners and does not require W2s or tax returns. The rate charged the borrower each period for the loan of money by custom quoted on an annual basis. Bank has received a B from the BBB with.

Our no-ratio loan program includes 30- and 15-year fixed-rate mortgages as well as 71 and 51 ARMs. Ad Personal Loans from 2000 to 36500 with a Fixed Monthly Payment at LendingPoint. The loan-to-value ratio is the amount of the mortgage compared with the value of the property.

Interest Rate Years. 15-year fixed-rate mortgages. Compared to a 30-year fixed mortgage.

Banks rating from the Better Business Bureau BBB is 112 out of 5 stars based on 595 reviews. No Ratio or NAV loan pursuant to the Documentation Table. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a.

With a No DSCR loan the same ratio used in a DSCR loan is considered but its not the primary consideration for the lender when it comes to the size of the loan and the price. Farms Vineyards Ranches and Agricultural Properties 25-30. Use Our Comparison Site Now.

A documentation option where the applicants income is disclosed and verified but not used in qualifying the borrower. Compare 2022s Best Unsecured Loans to Enjoy the Best Perks in the Market. SFC 443 which is defined as.

Boosting Access To Credit And Ensuring Financial Inclusion For All Oecd Economic Surveys Costa Rica 2020 Oecd Ilibrary

India Employment To Population Ratio 15 Male 2022 Data 2023 Forecast 1991 2021 Historical

No Payment No Problem Bizarre New World Of Consumer Debt Wolf Street

Mortgage Glossary Quicken Loans

Loan Manager Resume Samples Velvet Jobs

No Ratio Loans Market Consulting Mortgage

Understanding Usda Construction Loans Rocket Mortgage

Republic Of Azerbaijan 2021 Article Iv Consultation Press Release And Staff Report In Imf Staff Country Reports Volume 2021 Issue 278 2021

Loan Manager Resume Samples Velvet Jobs

:max_bytes(150000):strip_icc()/Capitaladequacyratio_fial-5905c5641fb541a2a6fe2d0ac4c32837.png)

What The Capital Adequacy Ratio Car Measures With Formula

:max_bytes(150000):strip_icc()/days-sales-inventory-dsi-final-f995b9bdd83f4c5a995b38576653fe02.png)

Days Sales Of Inventory Dsi Definition Formula Importance

No Ratio Mortgages Mortgagedepot

Pdf Capital Adequacy Ratio Loan To Deposit Ratio Operational Costs On Operational Income The Influence On Return On Equity Survey Of Foreign Exchange National Private Banks Listed On The Indonesia Stock Exchange

:max_bytes(150000):strip_icc()/Debtratio-final-467aac5bb30d46d8b9cd4f052fb2e858.png)

What Is The Debt Ratio

Uzbekistan Uz Bank Liquid Reserves To Bank Assets Ratio Economic Indicators Ceic

250k Offset On 700k Loan Is Generating 11 34 Return No Tax Is This Correct R Ausfinance

Nigeria Ng Employment To Population Ratio National Estimate Aged 15 Male Economic Indicators Ceic